Did You Know?

You can Recover all your Funds in case you are scammed?

You can Recover all your Funds in case you are scammed?

Active user

satisfied

Reviews

partners

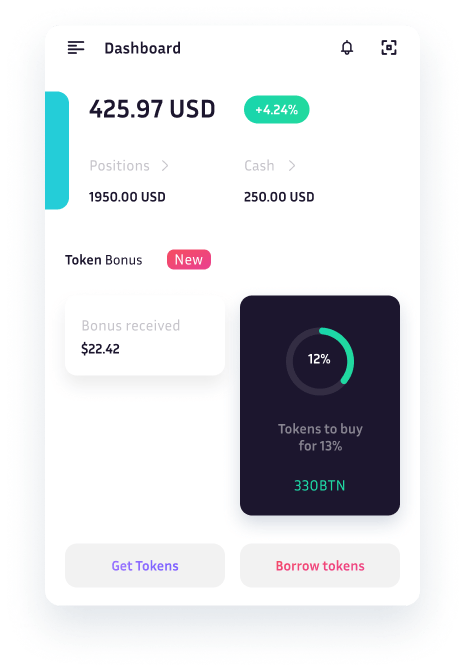

You may want top security so that you can rest assured that your accounts will not be compromised while you're using the platform

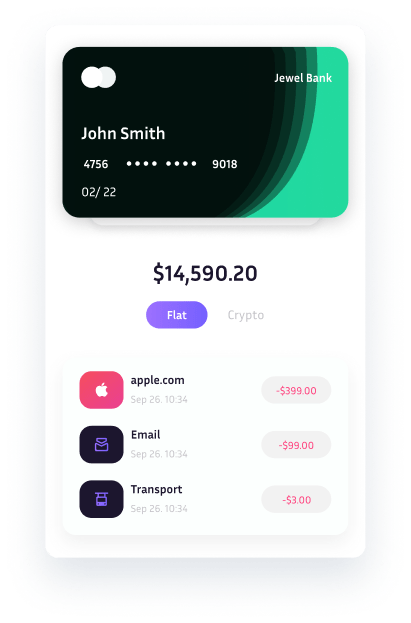

A prepaid card allows users to load money in advance, enabling secure transactions without linking to a bank account.

Refunds are reimbursements issued to customers when a product is returned or a service is canceled, often credited back swiftly.

The Save Your Card feature securely stores payment information for future transactions, streamlining the checkout process and enhancing convenience.

Pay Bill services enable users to manage and settle their recurring expenses online, promoting timely payments and avoiding late fees.

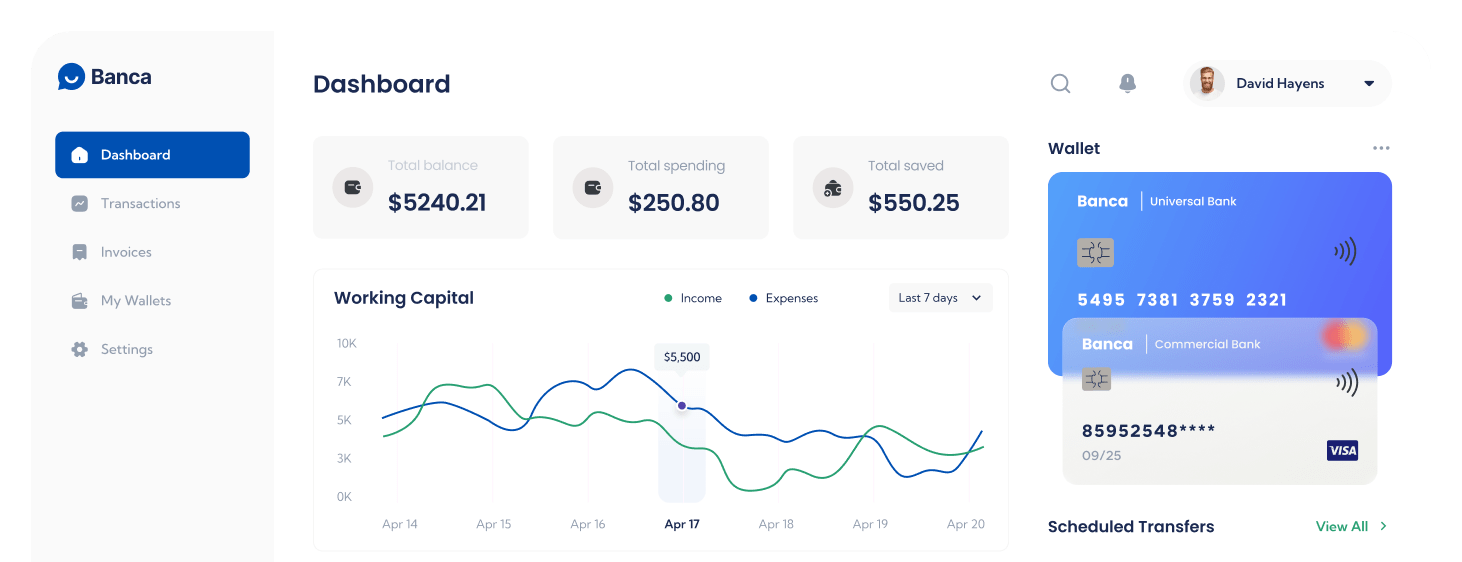

offers quick, convenient access to banking services anytime, anywhere.

provides fixed funding for a specific period, repaid regularly.

A refund is a repayment to customers for returned items or canceled services.

ensure safe delivery of funds and sensitive financial documents.

enable global banking access, facilitating international transactions seamlessly.

simplify costs into a single payment for clarity.

solutions streamline transactions, enhancing efficiency for businesses and customers.

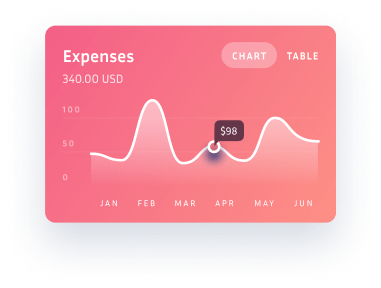

Set challenges Set small challenges to motivate yourself to save. Setting smaller goals

within your larger goals can be more engaging in tracking

Make a Payment. Cardholders can pay any outstanding balances on their Citibank Simplicity Credit Card by logging in to their online account.

If you have chosen to order a Security Key, you will be entitled a 30-day period after self-registration, which is referred to as ‘Security Key Activation Grace Period’. During this period, you can log on to Personal Online Banking.

focuses on making budgeting and banking straightforward and accessible for everyone.

You can be given a loan with just a single terrm fee

we operate in so many locations worldwide

Online Security involves measures to protect personal and financial information during digital transactions and communications.

ensures the protection of credit and debit cards from theft, fraud, and unauthorized use.

emphasizes precautions to take when using automated machines to avoid theft and ensure security.

The Simple Loan Register Process streamlines application steps, making it easier for borrowers to secure funds.

Access to Secure Banking ensures customers can manage finances safely through encrypted platforms and robust security features.

Calculate and Confirm Your Loans helps borrowers assess loan amounts, interest rates, and repayment terms accurately before approval.

I’ve had a fantastic experience with this bank. Their customer service is prompt, friendly, and always helpful with my inquiries.

The online banking platform is easy to navigate. I appreciate the secure transactions and helpful tools for managing my finances.

I recently applied for a loan and was impressed by the quick approval process. Highly recommend their services to everyone!

This bank offers competitive interest rates and excellent financial advice. Their knowledgeable staff helped me make informed decisions about my investments.

I love the mobile app! It makes managing my accounts and transferring money incredibly convenient, all from my smartphone.

The ATM network is extensive, making withdrawals hassle-free. I rarely encounter fees, which is a huge plus for me.

Their commitment to online security gives me peace of mind. I feel safe managing my finances with this bank’s services.

I appreciate the transparent fee structure. There are no hidden charges, which is a refreshing change in the banking industry.

Questions you need answers to always.

To reset your password, go to the login page and click on the "Forgot Password" link. You will be prompted to enter your email address and a reset link will be sent to you.

We accept various payment methods, including credit cards, debit cards, and bank transfers. You can easily track your purchase order online.

Our return policy allows returns within 30 days. For assistance, contact our support team via phone, email, or online chat.

A mutual fund pools money from multiple investors to invest in diversified assets, allowing compound interest to grow returns over time.

A budget is a financial plan detailing expected income and expenses, helping individuals manage their finances effectively and achieve financial goals.

The diversification strategy involves spreading investments across various asset classes to minimize risks and optimize potential returns in changing markets.